how to calculate pre tax benefits

For example pre-tax deductions for retirement investment. In this final step deduct the entire expense total.

How Are Payroll Taxes Calculated Federal Income Taxable Wages Zenefits

For example if you make 12 payments of 1400 over the course of the year that adds up to a debt service of 16800.

. HSA Tax Savings Calculator. Average Cost of Employer-Sponsored Health Insurance Jun 14 2022 If you do choose to offer health. Go online and get a copy of IRS Circular E.

Actual Cost Of Pre-Tax Contributions. The results provided are an estimate based on the information provided in the input fields. So a pre-tax plan can also save you tax dollars by decreasing your.

50000 30000 20000. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover. Actual results may vary.

Subtract the value of your debt service from your NOI. You are responsible for calculating the estimated fair market. In short with pre-tax benefits the benefit cost is deducted from an employees paycheck before income and.

2000 300 1700. Finance costs include the interest paid by the business on the loans taken from the bank. Divide Saras annual salary by the number of times shes paid during the year.

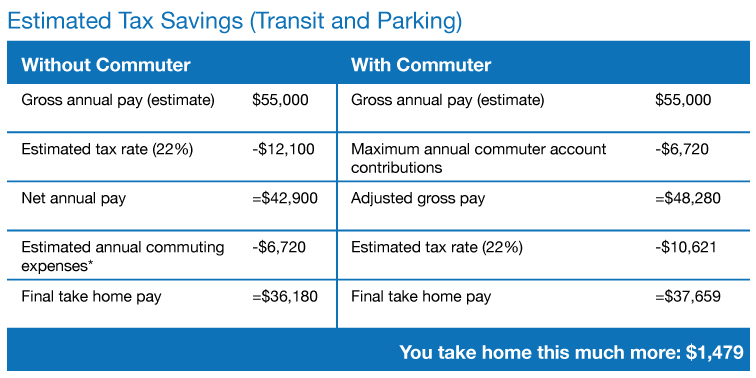

Figure your insurance amount for each pay period. Calculate how much more money you could take home when you use a pre-tax benefit. When you enrolled in the plan your employer should have given you the amount which would be deducted from your paychecks.

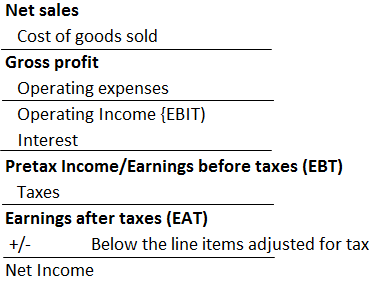

A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover taxes. You calculate the pre-tax earnings by subtracting operating and interest expenses from your gross profit. For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis your taxable income for the year would have been 27000.

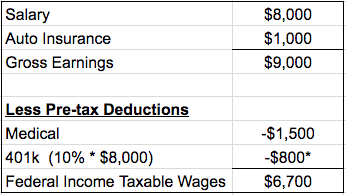

After deducting the health insurance premiums the employees pay is 1700. Figure federal income tax by retrieving your allowances and filing status respectively from lines 3 and 6 of your W-4 form. Pre-tax income often known as gross income is your total income before you pay income taxes but after deductions.

How to calculate imputed tax Just like their regular pay this imputed income is taxable income for the employee. Note that other pre. First indicate if you are insuring.

How to calculate pre-tax health insurance. This calculator will show you just how much you are saving in taxes by making contributions to a Health Savings Account HSA. Calculate the employees gross wages.

Her gross pay for the period is 2000 48000 annual. And transportation benefits such as parking and transit fees. Then find the tax.

Choose Your Profile profilename Drag Slider to Estimated Tax Rate. 17000 X 765.

4 Ways To Maximize Savings With Pre Tax Deductions

Pretax And After Tax Deductions Payroll Management Inc

What Are Marriage Penalties And Bonuses Tax Policy Center

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

What Are Payroll Deductions Article

What Are Pre Tax Deductions Definition List Example

Pretax Income Formula Guide To Calculate Earnings Before Tax Ebt

Net Operating Losses Deferred Tax Assets Tutorial

Hre Das Hrexpress September 2021 Iowa Department Of Administrative Services

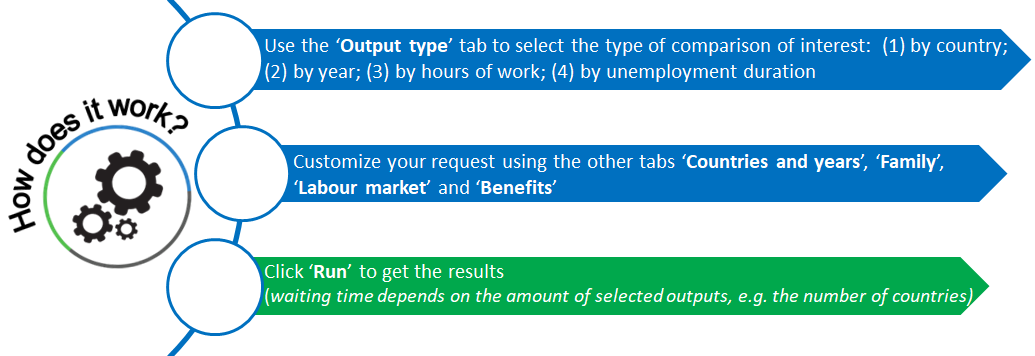

Tax Benefit Web Calculator Oecd

Commuter Tax Benefits Nj Transit New Jersey Transit Corporation New Jersey

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Salary Paycheck Calculator Calculate Net Income Adp

Investment Expenses What S Tax Deductible Charles Schwab

Roth 401k Roth Vs Traditional 401k Fidelity

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)